Build-to-Rent: A Complete Guide for Rental Property Investors

Traditionally, new homes are built with owner-occupants in mind. Plenty of homes serve as rentals, of course — that’s the subject of this entire blog! — but rental homes are typically a bit older, a bit smaller, with less expensive finishes. By contrast, new homes usually have all the nicest stuff in order to attract high prices from homebuyers.

However, a new trend is emerging: new homes built with the express purpose of serving as rentals. This is called “build-to-rent”, or BTR (or interchangeably “build-for-rent”/BFR). While this is still a small sliver of the overall new home market, it is growing rapidly.

In this article, I’ll take a deep dive into the emerging phenomenon of build-to-rent: what it is, how it works, where it’s happening, and most importantly WHY it’s proving to be such a successful model.

I’ll also discuss my own personal experience with a BTR property, and share the financial numbers for that house since I bought it 5+ years ago. At the end of the article, I’ll tell you how you can get in on BTR properties as a rental property investor.

What is Build-to-Rent?

Build-to-rent is just what it sounds like: the segment of the housing market that consists of new homes built expressly for the purpose of renting. These are most often detached single family homes, but they can also be townhomes, duplexes, and other configurations.

Build-to-rent homes are sometimes developed as an entirely new community, whereas in other cases they are built on single vacant lots in existing neighborhoods. For newly-developed neighborhoods, there are two different ownership/management models: either all the homes are sold to a single owner (such as an institutional investor) to be managed as a rental community, or the homes are sold individually to investors who then manage the property themselves or with their property manager.

What Makes Build-to-Rent Different?

Build-to-rent homes tend to be different in many respects from other new construction. In particular:

BTR homes will tend to be a bit smaller

BTR homes will tend to have fewer bedrooms/bathrooms — 3 bed/2 bath would be typical, vs. 4+ bed/3 bath in many other newly built homes

BTR homes will tend to have less expensive finishes — i.e. LVP instead of hardwood floors, cheaper countertops, etc.

BTR homes will tend to have smaller lots (if they’re in newly-developed communities)

Notice that I say “tend to” for each of the points above. This is because individual builders may make different choices for BTR homes depending on the neighborhood, market, intended sale price, and more. But in the aggregate, these differences will hold.

The Growth of Build-to-Rent

Getting precise data on the growth of build-to-rent is a bit tricky. Still, all analyses I found paint the same picture of accelerating growth since 2021. For example, here’s a look at the count of completed BTR properties since 2014 according to a RentCafe analysis:

According to this analysis, another 45,000 BTR homes are slated to be completed in 2024 and 2025, which means that the record annual pace from 2023 is continuing.

Other sources come up with different numbers. This report says the number of BFR homes built in 2023 was 75,000, nearly 3x the RentCafe analysis. (Like I said, it’s hard to get clear figures on this.) But both sources show the same rapid growth since 2021.

Despite the rapid increases, BTR is still a very small percentage of total new homes being built. As I discussed in my article on the US housing shortage, a typical year sees about 1.5M new residences built, of which about half are single family homes. Depending on which BTR data source you use, that means that BTR currently represents between 2-5% of all new residences being built, and 4-10% of all new single family homes. Still a small piece, but it’s growing.

BTR is not evenly distributed across the country, either. Builders look for just the right conditions to develop BTR communities. Adam Stern, CEO of Strata SFR, a brokerage focused on BTR and portfolio sales, put it this way: “BTR is growing most in places where rents are still affordable but growing fast, with growing employment and positive inbound migration. When a market's land and home values get too high, without rent growth that keeps pace, the numbers for BTR development don’t work as well. So smart builders are looking for areas that exhibit these characteristics where the cost to build a home and the price of rents are in exactly the right balance to make a deal profitable as a BTR.”

So where do those conditions exist? Mostly in mid-sized, fast-growing markets concentrated in the Sun Belt. Here are the leading markets for completed BTR homes in 2023:

Clearly, BTR is catching on fast. But WHY is it proving to be so popular? Let’s explore the benefits of build-to-rent from the perspectives of the three primary parties to a BTR deal: the builder, the landlord, and the tenant.

The Benefits of Build-to-Rent

For Builders

Through the eyes of builders, BTR has some distinct advantages. First, they can construct BTR homes more quickly and cheaply than other homes, using identical layouts and less expensive finishes. This helps their profit margins, and also may speed up city approvals and permitting.

Builders can also use smaller lots, and therefore build more homes in the same amount of space. This is driving many BTR developments to opt for townhome-style residences instead of detached homes. “There are a lot of townhome BTR deals out there, because you can fit more townhomes on a parcel of land than single family homes,” according to Stern. “Therefore the price per unit can be lower while the rent is not that much lower than a detached single family home.”

In addition, builders have the option of selling the ENTIRE neighborhood of homes to a single buyer. “For builders, BTR represents an alternate source of demand,” Stern said. “In a market where there are so many unknowns, having bulk sales options, even at lower per unit pricing, is invaluable in terms of being able to plan ahead. The presence of this alternate exit option is, at the very least, a safety net for builders in an otherwise scary market.”

For Tenants

For would-be homebuyers, the current market is pretty scary as well. They face high home prices and high mortgage rates, which is reducing their purchasing power significantly. Also, there is a dearth of starter homes, the construction of which is now nearly non-existent due to the difficulty of building them profitably.

For many, renting may be their next best option. BTR gives them access to new homes with a modern feel, along with professional management and (in some cases) community perks like fitness facilities, pools, and common lounges. They get these benefits without having to commit a large downpayment to a purchase, without taking on debt, and while maintaining the flexibility to move without the hassles of a sale. Especially for younger generations, this can be the ideal living situation.

For Landlords

Whether a BTR community has a single owner or the homes are sold off piecemeal to individual owners, there are many benefits of the BTR model from the perspective of the landlord:

Cheaper to buy: Compared to other new construction, BTR will tend to have somewhat lower prices due to the smaller space, cheaper finishes, and the desire of the builder to sell many units quickly.

Easy to maintain: With a brand new home, you can expect a pretty smooth ride — low maintenance costs, and low CapEx (at least for the first 5-10 years.) This is similar to the benefits of turnkey properties, but taken to the next level because everything, even the plumbing, electrical, etc., is brand new.

Strong rental demand: BTR homes are very attractive to tenants, and therefore tend to rent quickly at strong rates.

New, high-quality asset: Many investors will prefer a new home to, say, a 1950’s era home.

Peace of mind: With BTR, the due diligence process is simplified, and you know exactly what you’re getting.

My Experience With a Build-to-Rent Home

If all this piques your interest as a rental property investor, you’re probably someone to whom the turnkey model also appeals. Many of the benefits of the turnkey model also apply to BTR, as I alluded to above — and I’ve always believed that turnkey is a viable, dependable option for many new investors, particularly those investing remotely. My personal experience with turnkey homes supports this, as I’ve consistently experienced lower maintenance costs and fewer hassles & susprises with turnkey properties, which is why I always encourage my private coaching clients to at least consider turnkey properties for their portfolios.

While I don’t have personal experience with a true BTR home, I do have one that’s very close: Property #12 was built in 2017, and I purchased it in 2019 with a tenant already in place. Here’s a peek at what it looks like:

Notice that the house looks very nice — it’s certainly one of my best properties — but not nice in the way that typical new construction would look. As expected, we find smaller houses on this block, sitting on smaller lots, with cheaper finishes. But for a rental home, it’s perfect.

My experience with this house has been TERRIFIC. Since I bought it 5+ years ago, I’ve incurred just $882 in regular maintenance expenses, and $0 in CapEx. I’ve turned the property twice, but the cost of BOTH those turns together was only $2,600 — this is because the property was in near perfect condition to begin with, and because the tenants have taken great care of the house. In both turns, I was able to place a new tenant at the asking rent in just a few weeks, demonstrating the strong tenant demand for these properties. I wish all my houses were like this!

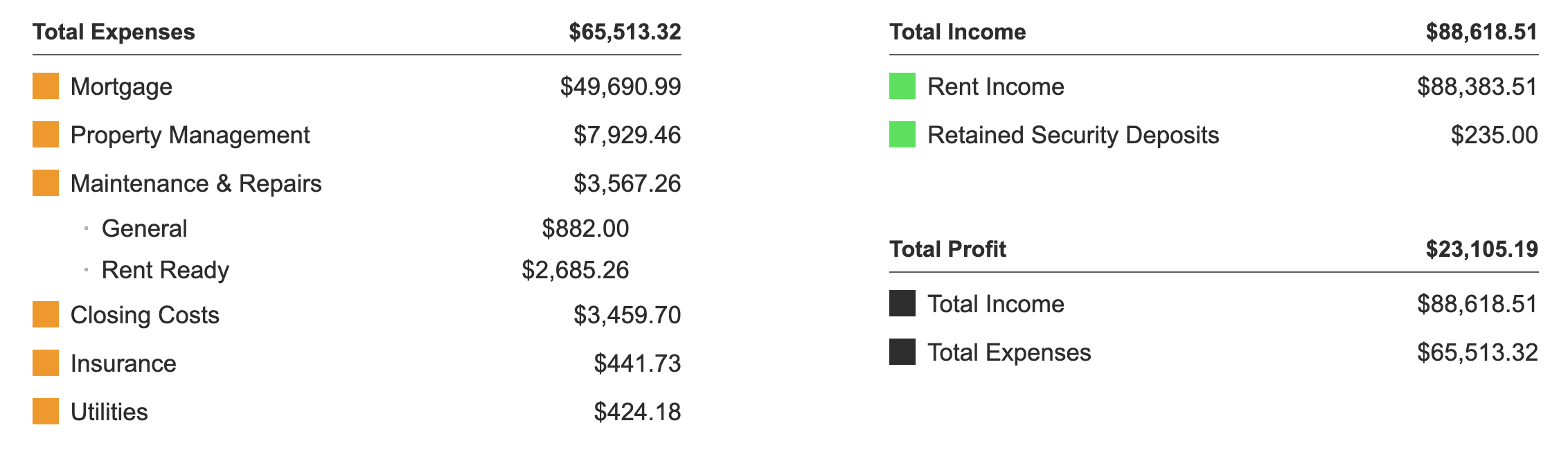

Here are the total numbers since inception on this property:

How to Buy a Build-to-Rent Home

Unless you’re a deep-pocketed institutional investor, you won’t be able to actively participate in BTR deals where the whole neighborhood is sold to a single owner. You can still get in on this action in a roundabout way through private equity funds, real estate crowdfunding, or REITs — but in general, I don’t much like these investing vehicles because of how much control you give up, and because you surrender the juicy tax advantages that come with rental properties.

For those reasons, I much prefer direct ownership of properties. If you want a BTR property in your rental portfolio, you’ll have to do it the way I did with Property #12: you’ll need to buy one in a BTR neighborhood that is being sold one house at a time, or one that was built on a vacant lot in an existing neighborhood.

Here are THREE good ways to find a BTR house like that:

Specialized Brokerages and Builders: You can go directly to the source by working with specialized brokerages that market BTR properties, or builders who market them directly to investors. There’s a useful list of such companies at buildforrenthomes.com.

Turnkey Providers: Increasingly, turnkey providers are partnering with local builders to offer BTR homes to their investor clients. This is especially convenient if you already have relationships with turnkey providers, and/or you’ve already selected your investment market and want to limit your search to that market. Where I invest in Memphis, all three of the large turnkey providers in my network are now offering BTR homes, and they are increasingly popular.

Search on Zillow: Finally, you can go the DIY approach and find newly built homes that meet your investing criteria on Zillow (or any other listing aggregator). It’s pretty simple: just use the search parameters to filter to properties built in the last 1-2 years!

Conclusion

Is build-to-rent the next big thing in rental property investing? Hard to say — but it’s certainly growing fast, and providing clear benefits to builders, tenants, and (most importantly for us) landlords. My personal experience with a BTR home reinforces why it may be an appealing option for rental property investors, particularly those investing from out of state.

To buy a BTR home, you’ll need to find a “one off” sale, either by partnering with a specialized brokerage, builder, or turnkey provider, or by finding newly built homes yourself that are publicly listed.

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.