Monthly Portfolio Report: August 2024

One of my goals with Rental Income Advisors is to be as transparent and data-driven as possible with my readers and my coaching clients. I think the best way to build confidence in a new investor is to actually show the numbers, to prove that rental property investing really does work as advertised.

For those reasons, I publish a monthly report on my portfolio’s performance. I hope that this chronological history paints a clear picture of what it’s like to be a remote landlord. It’s also a great exercise for me to be sure I’m staying plugged in to all my numbers.

Here is the update for August 2024. You can also check out all my previous monthly reports and annual reports.

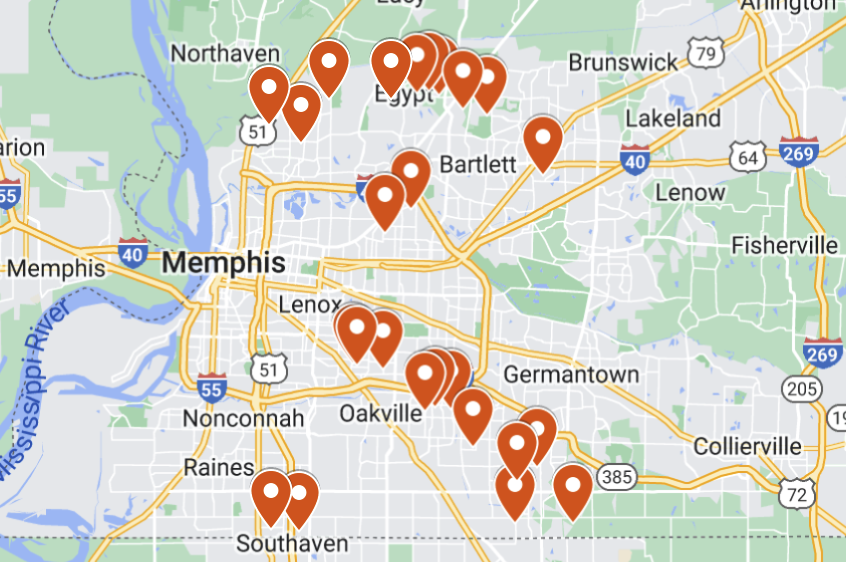

Property Overview

Finally back to fully occupied this month!

I had a number of turns over the past few months, but new tenants have now been placed into all those vacancies. So things are stable — with the exception of a non-paying tenant who has recently entered the eviction process. More on that in the next section.

Rental Income

My tenant at Property #11 failed to pay rent in August, and has entered the eviction process. I’m hearing from my PM that the courts are backed up, which means it could take months just to get a court date. If the eviction goes through, this would be my second one this year, following two others last year. Prior to that, I only had about one per year — but my portfolio is also somewhat larger now.

Plus, there’s always the chance that the tenant will avoid the eviction. This tenant got behind in 2022 as well, and eventually got caught up. They’ve been in the home for 6 years, so I very much hope they’re able to get back on their feet. Per usual, My PM is also offering to get them connected to sources of rent assistance, but so far the tenant has not been responsive.

We’ll see how this plays out…

Expenses

This screenshot comes from RentalHero, the online accounting tool I use for my portfolio.

Some detail on my expenses this month:

Maintenance & Repairs: As I mentioned last month, I’m dealing with a monster issue at Property #6: a neighbor’s tree fell on the house, causing significant damage. It cost me $2,500 to remove the full-sized tree from the house, and another $16K to repair the roof system and other parts of the structure that were damaged. That’s most of what you see in my enormous $20K maintenance & repair costs this months. Insurance payments of over $13K also came in this month, covering all but my $5K deductible, so the financial pain was significantly mitigated — but still, it was a big hit.

Property Management: My PM fees were more than $1K higher than normal due to two leasing fees for the placement of new tenants at Properties #7 and #23.

Property Taxes: This reflects the direct payment of 2024 City of Memphis property taxes on the 6 properties that I either own outright, or where my lender does not collect escrow. (For all other properties, the funds for property taxes are escrowed, and reflected in my mortgage payments.)

Utilities: This is for the ongoing vacancies at several properties — this should be the end of these costs for now, though, since new tenants have been placed in all those vacancies.

Tenant Chargeback: This was an expense deemed to be the tenant’s responsibility. I pay for it upfront, but once the tenant pays my PM, I’m reimbursed for the cost.

Legal Fees: As referenced in previous monthly reports, there was an issue at Property #22 in which the vacating tenant from last year brought a claim against my PM for (rightly) withholding the security deposit. My PM didn’t notify me about this, and chose to settle the claim with the tenant — but then charged me a bunch of their legal fees for the conversations they had with their law firm in the course of dealing with the issue. I objected to not being notified, and also to the fees I was charged. The $500+ credit this month reflects the accommodation I negotiated from my PM…though to be honest, I’m not that happy about the resolution, because this represents only about 30% of what they charged me, and it took MANY months to reach this conclusion.

The Bottom Line

My financial model currently projects my Memphis portfolio to generate $9,506 of positive cash flow in an average month. This month, my cash flow was only $3,739, nearly $6K short of my target. This is due to a combination of elevated maintenance costs (even after the insurance payment), property tax payments, leasing fees, and the unpaid rent at Property #11.

This year continues to be the most challenging one I’ve had so far in my portfolio. Hopefully things will stabilize in the fall and I can make up a little ground with my cash flow — but no matter what, it will be a “down” year, especially if the situation at Property #11 results in months of nonpayment and an eventual eviction. But of course, rental property investing is a LONG GAME over decades, so you can’t get too distracted by the month to month (or even year to year) fluctuations.

Finally, here’s the running tally and graph I update each month. The dotted blue line indicates my projected average monthly cash flow for my portfolio in each given month. The recent flow of red ink has continued, and I’m now more than $15K behind my year-to-date cash flow target.

Free Rental Property Analyzer

Need help running the numbers on rental properties? Want to be more confident in your financial projections?

Check out the FREE RIA Property Analyzer. I guarantee this is the most intuitive, elegant, and powerful free tool you’ll find to run the financials on rental properties. I still use it every day, and so do all my coaching clients.

OR

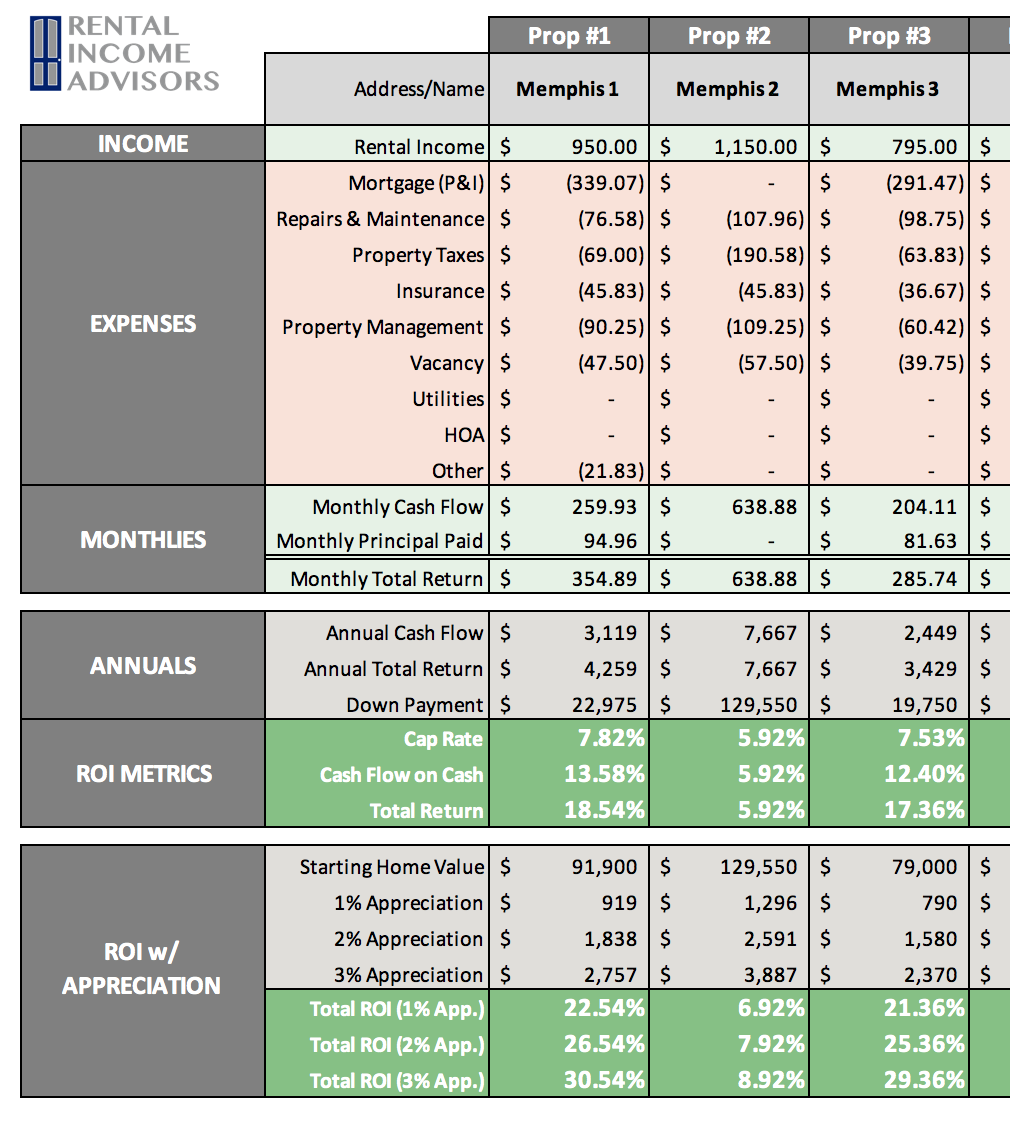

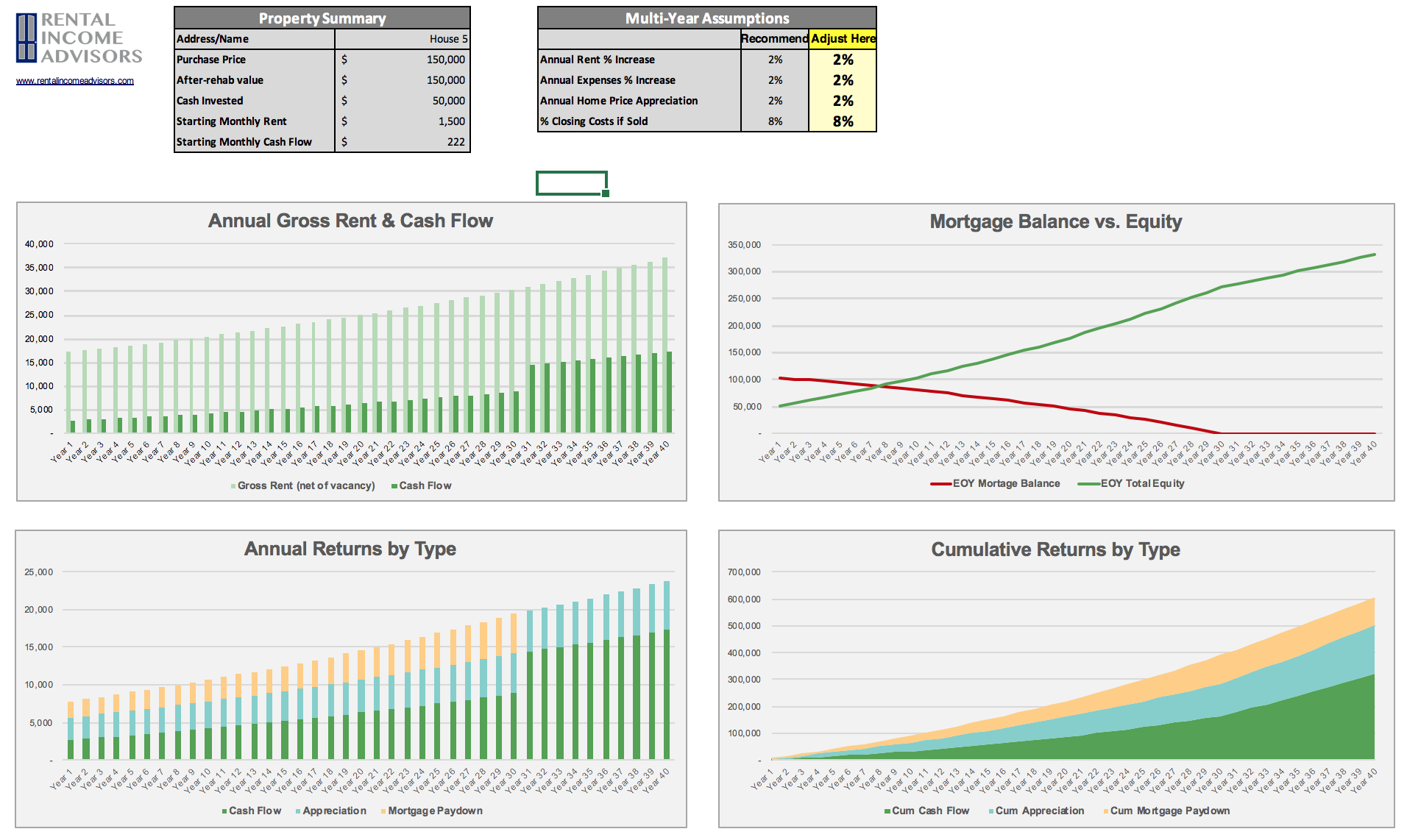

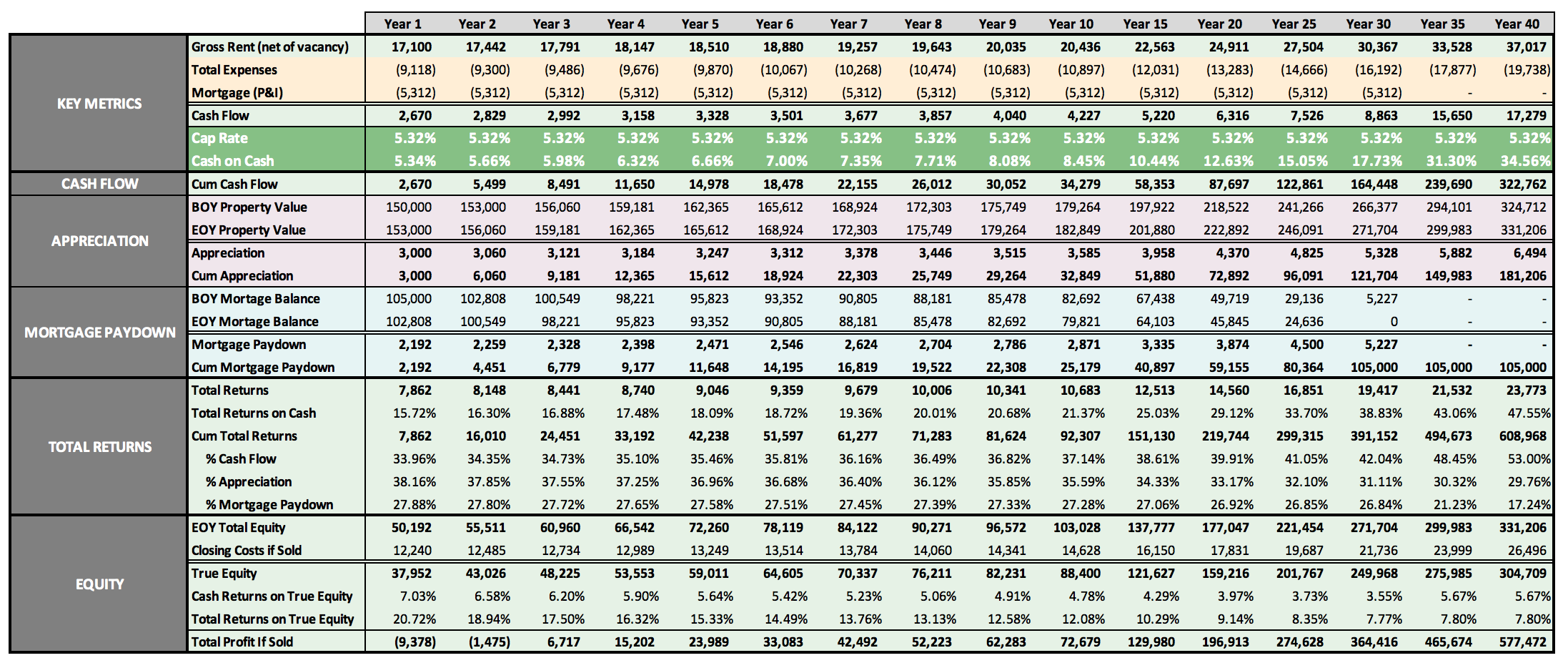

Here’s what the Property Analyzer looks like:

About the Author

Hi, I’m Eric! I used cash-flowing rental properties to leave my corporate career at age 39. I started Rental Income Advisors in 2020 to help other people achieve their own goals through real estate investing.

My blog focuses on learning & education for new investors, and I make numerous tools & resources available for free, including my industry-leading Rental Property Analyzer.

I also now serve as a coach to dozens of private clients starting their own journeys investing in rental properties, and have helped my clients buy millions of dollars (and counting) in real estate. To chat with me about coaching, schedule a free initial consultation.